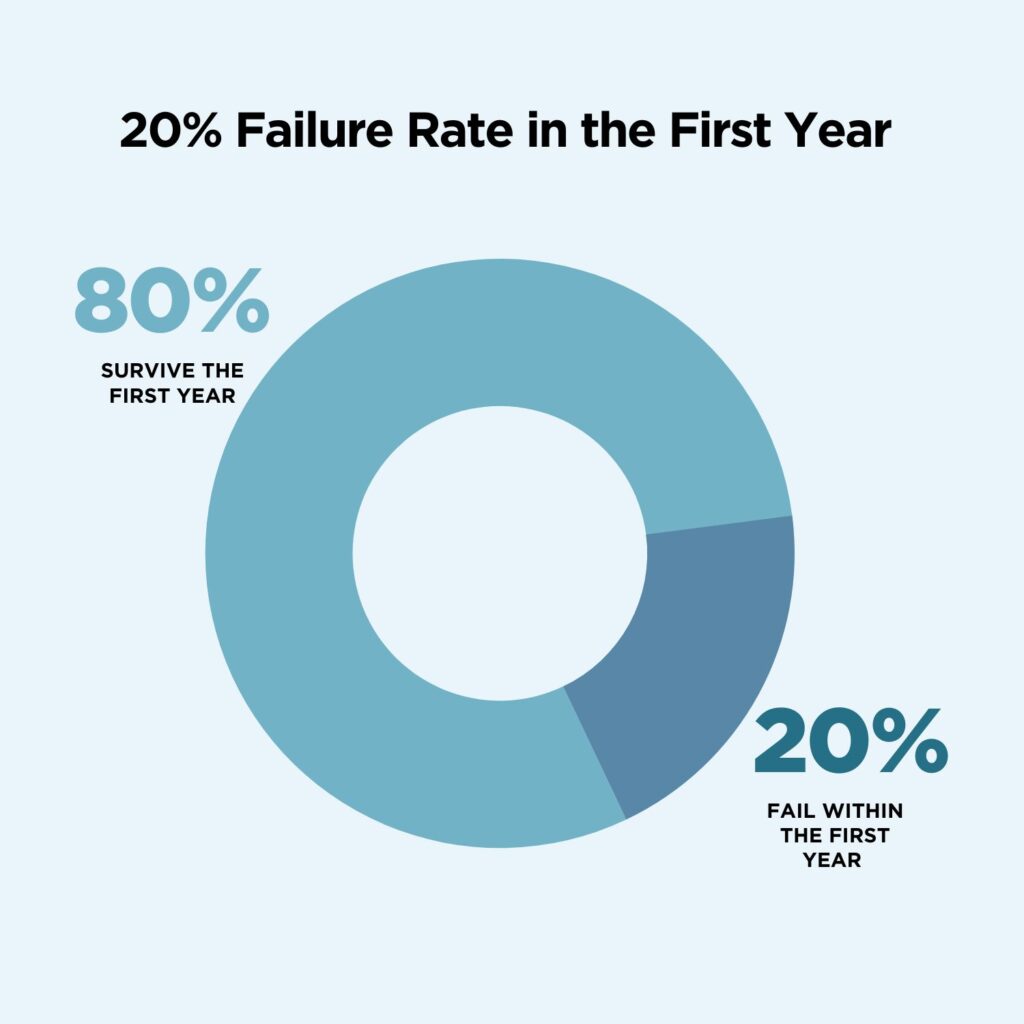

This is the stage before the business proves to the business owner that it has potential to succeed. Research tells us that 20% of all startups fail in the first year. Only 50% make it to year 5. Typically these businesses cannot afford to retain a expert business advisor but benefits instead from services available from LEO’s targeting businesses with 10 or less employees. Often, the owner strives to bring employees into the business to create scale so that most of the wealth is being created by the employees in the business. Traditionally, the LEO’s have set a threshold of 10 employees to denote a kind of transition from this stage to a higher level. Most small businesses in Ireland stay in this space without growing out of it. Many business owners have no desire to grow past that. Growth is a choice made by the business owner – it requires energy, openness to new approaches, a talent for managing people and an appetite for risk. The fact is that the vast majority of business owners quite happily stay at this or the next stage of development.

At this stage, the owner is still involved in everything in the business. The employee numbers may go above 10, but operations and finance roles within the business are still often not clearly defined. The owner typically makes business growth happen through leading sales. Web, social media, branding, people management, cash flow, collections, business planning, marketing and sales all involve the business owner to a greater or lesser extent. Outsourcing of HR, web/social media and accounting is used extensively but often not managed rigorously. The main area of focus is in “making it easy for our customers to do business with us”. Cashflow is the other focus area combined with the challenge of finding working capital from banks or investors to grow the business. The business is typically still not saleable due to the lack of a management team and the near total dependence on the business owner. A business owner will often retain an external business advisor at this stage to help develop and evolve the business through one-to-one coaching sessions and business owner peer board participation.

When the operations and finance management roles have been established and the business starts to grow so that functions which were outsourced like HR and Marketing Operations start to be added so that the senior manager team goes from 2/3 to 4/5. Employee numbers often go from 10 or more to 25 to 50 at this stage. Geographic expansion may become an objective. The owner role starts to shift away from day-to-day operations and toward financing, growth and strategy. Longstanding early employees often leave at this stage and the culture of the business and hiring process become an area of sharper focus from the owner and management team. The mix of products and services evolve through innovation or acquisition. Valuing a mid-stage business for sale/exit purposes is difficult due to the absence of audited accounts (typically) on which to judge the goodwill value as a multiple of earnings for the past 3 years. Usually, the business owner’s involvement is still at a very high level which means acquisition involves a lengthy earn-out period post-deal at a minimum. An expert business advisor will typically be retained to provide external input and perspective. They may be used to provide structure to management review meetings and the early-stage introduction of business review, target setting and performance review processes.

At this stage, the owner is building or has built a professional executive team. An external business advisor is typically retained so that quarterly business planning reviews and an annual strategic planning away day are established. Professional roles in HR, purchasing, and contract management, are added. The business owner is working towards a classic governance structure consisting of a board of directors and an executive management team. Keeping the pace, dynamism and culture of the business intact as it grows is a key concern. The owner/founder puts more distance between themselves and the business by having a CEO or equivalent. At this scale, some kind of market dominance position is being carved out so that regulation, competition law, intellectual property and distribution rights are under constant review. At this stage, the business is much more easily saleable. The owner could reasonably expect to carry a goodwill multiple matching or exceeding 3 times EBITDA for valuation purposes but by no means should the business owner’s journey end there. To summarise, every business owner has their own unique journey to take with their business. Very few grow their businesses to launch on the stock market. Many grow their businesses to a point where they successfully sell them to someone else. Many do not. As a business owner, ultimately you decide.

Independent Business Advice, Coaching and Business Owner Peer Group Facilitation.